US BANK PARTNER CARD

ORDER A NEW CARD

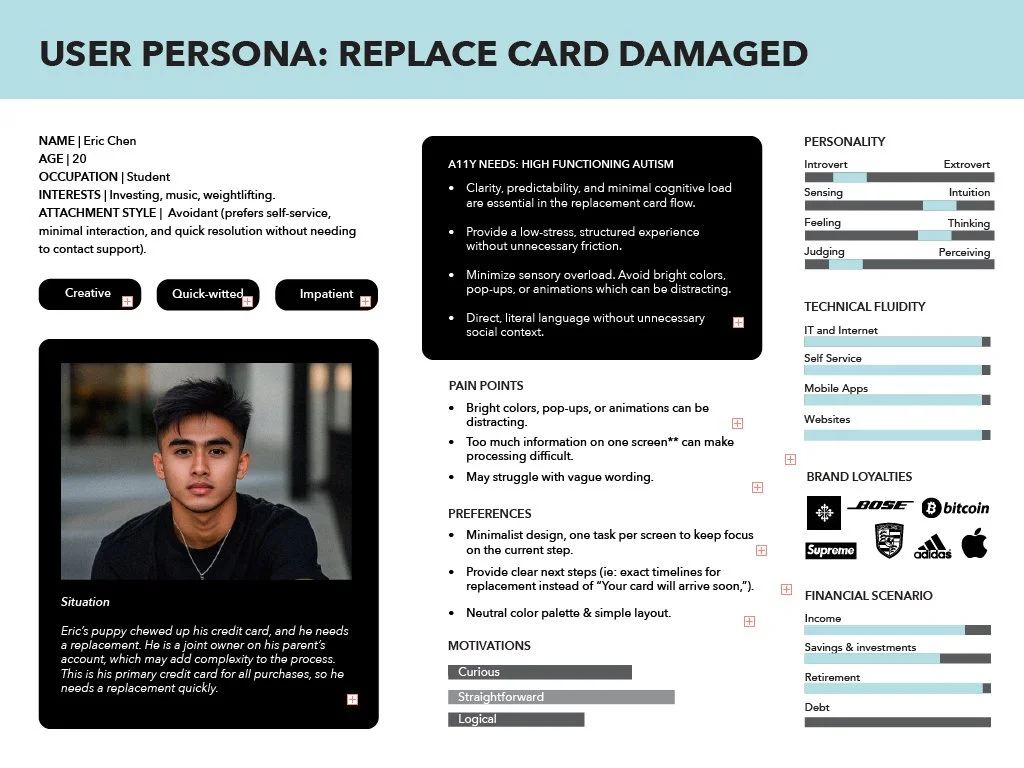

ROLE

Product /UI Designer

User Research, Interaction, Visual design, Prototyping

& QA Testing

Applications

Mobile (iOS & Android) & Web

July 2022 - January 2025

The challenge

Design a card replacement experience for US Bank and Elan Partner Card customers dealing with damaged cards - a frustrating but low-stakes inconvenience that shouldn't require a branch visit or phone call.

Previous flow challenges:

Automatically sent primary account holder a card even when not needed ($25 wasted per unnecessary card)

Too many steps for a simple non-security issue

No immediate solution while waiting for physical card

Business goals:

Increase completed orders

Reduce "never received" reports (indicating successful delivery)

Save US Bank and Elan resources on unnecessary card production and customer service calls

Key Insight

Damaged cards are an inconvenience, not a crisis. The flow should be fast and straightforward - but smart enough to handle edge cases without overwhelming users or wasting company money.

The Solution

When your card is stolen, the last thing you need is confusion.

This redesign stripped away friction and added clarity—making a crisis moment manageable.

Streamlined the card replacement flow for the Elan Partner Card platform and built intelligent logic to handle multiple scenarios without forcing unnecessary card replacements.

Design decisions:

Simplified entry point connecting to Lost/Stolen flow when needed

Advocated against PM's multi-card selection feature - users rarely damage multiple cards simultaneously, adding complexity for an edge case

Added smart single-card selection for account holders - only replace what's needed

Reduced screens by combining shipping with review

Added instant digital card access for immediate use

The Impact

$25 saved per unnecessary card across thousands of Elan and US Bank replacement orders

Simpler flow by eliminating unnecessary features = faster completion

Digital card feature = immediate relief while waiting for physical card

Reduced customer service calls through self-service completion

Research & Discovery

Analyzed existing card replacement patterns:

Damaged card scenarios typically involve single cards (unlike lost/stolen which often affects multiple cards)

Previous flow automatically replaced primary account holder card regardless of need

Each unnecessary replacement cost $25 (card production + shipping)

User insight: Users dealing with damaged cards face inconvenience, not crisis. They need speed and simplicity, not security theater.

Business discovery: Identified opportunity to reduce costs while improving experience through smarter card selection logic.

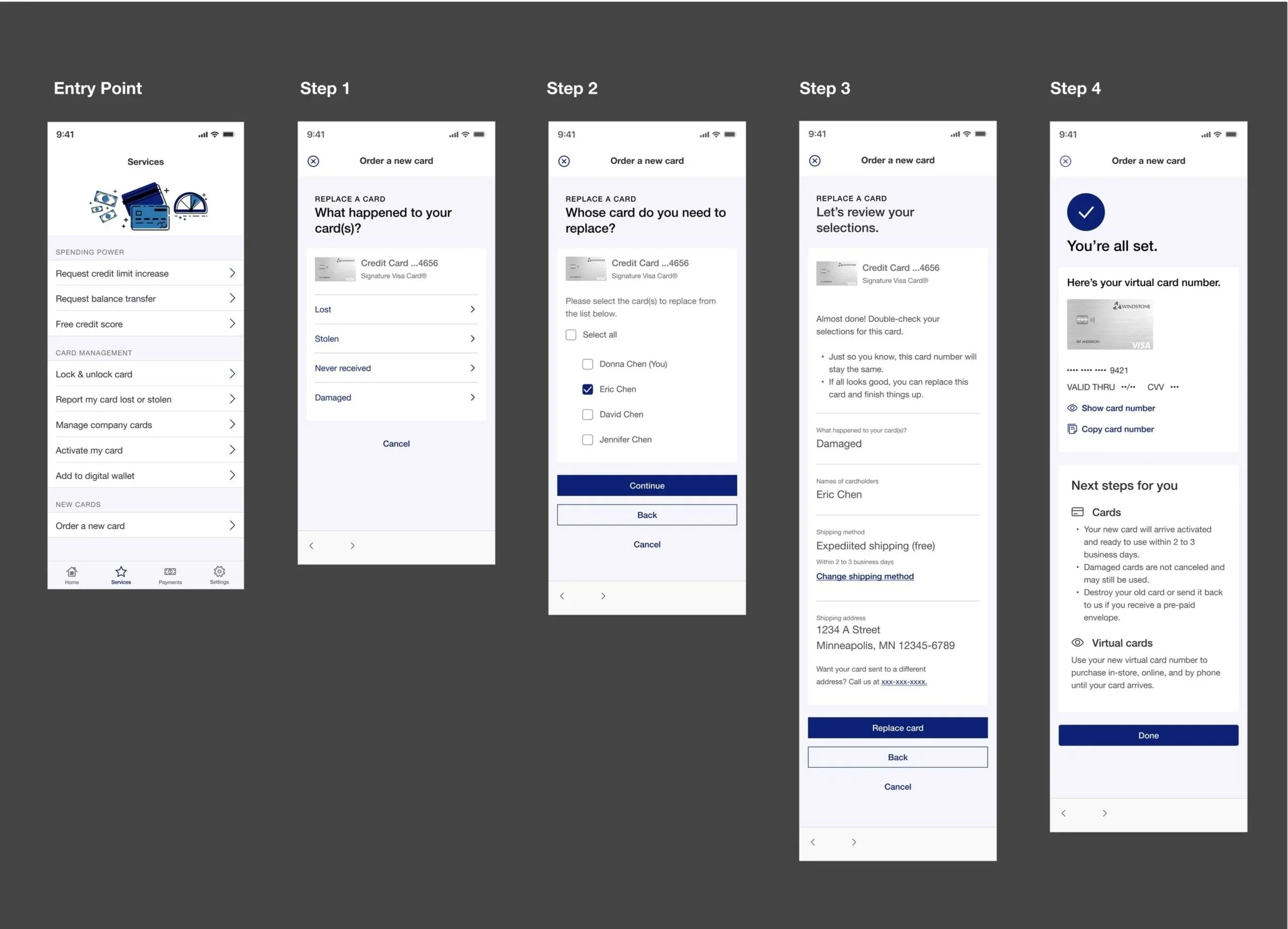

The Flow

Damaged cards are annoying, not devastating. This flow gets people what they need without making them work for it.

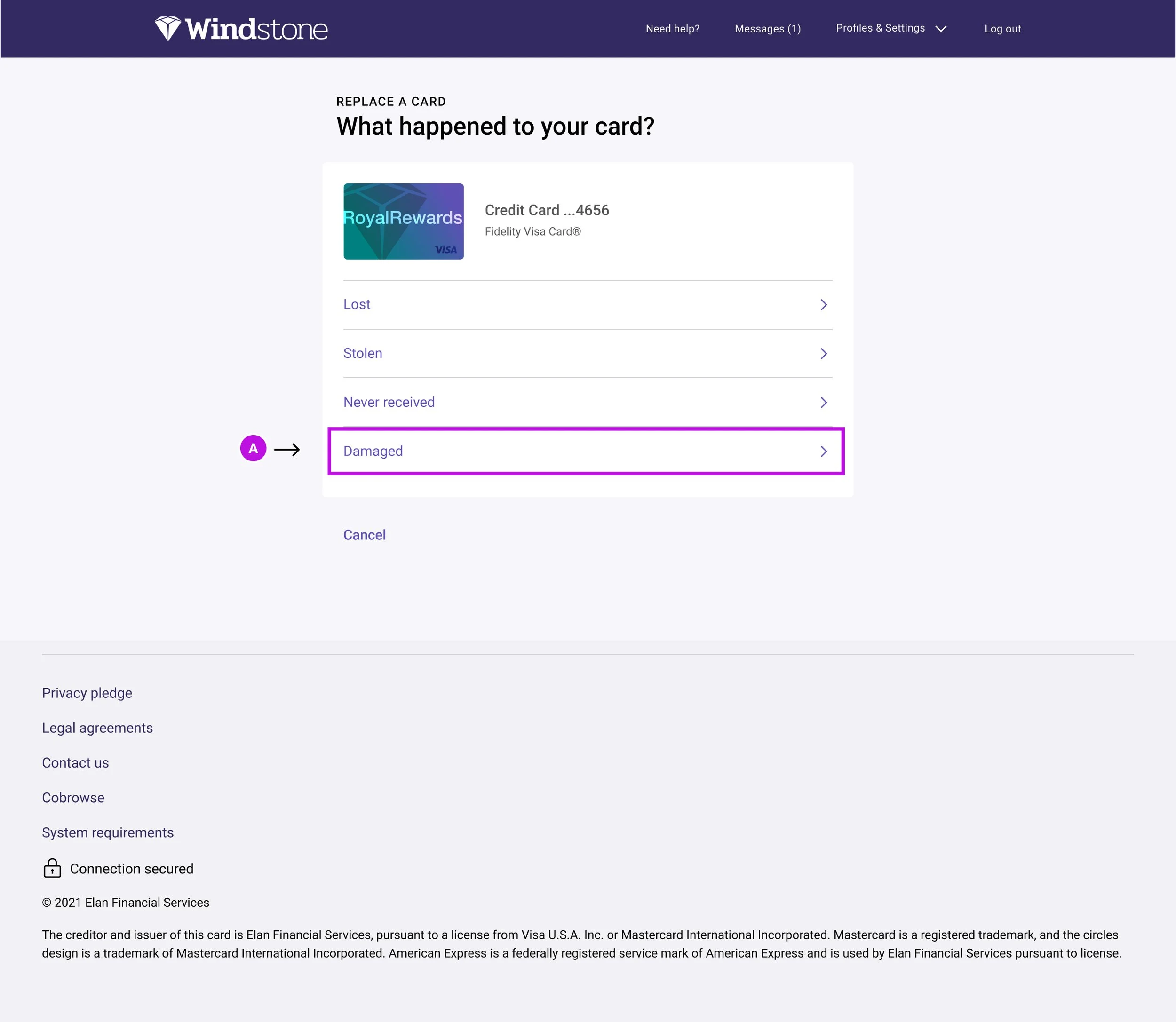

A. Smart routing from single entry point

Users selecting "Damaged" enter simplified replacement flow

Lost/Stolen/Never received route to fraud-protection flow

One entry point, two experiences based on security needs

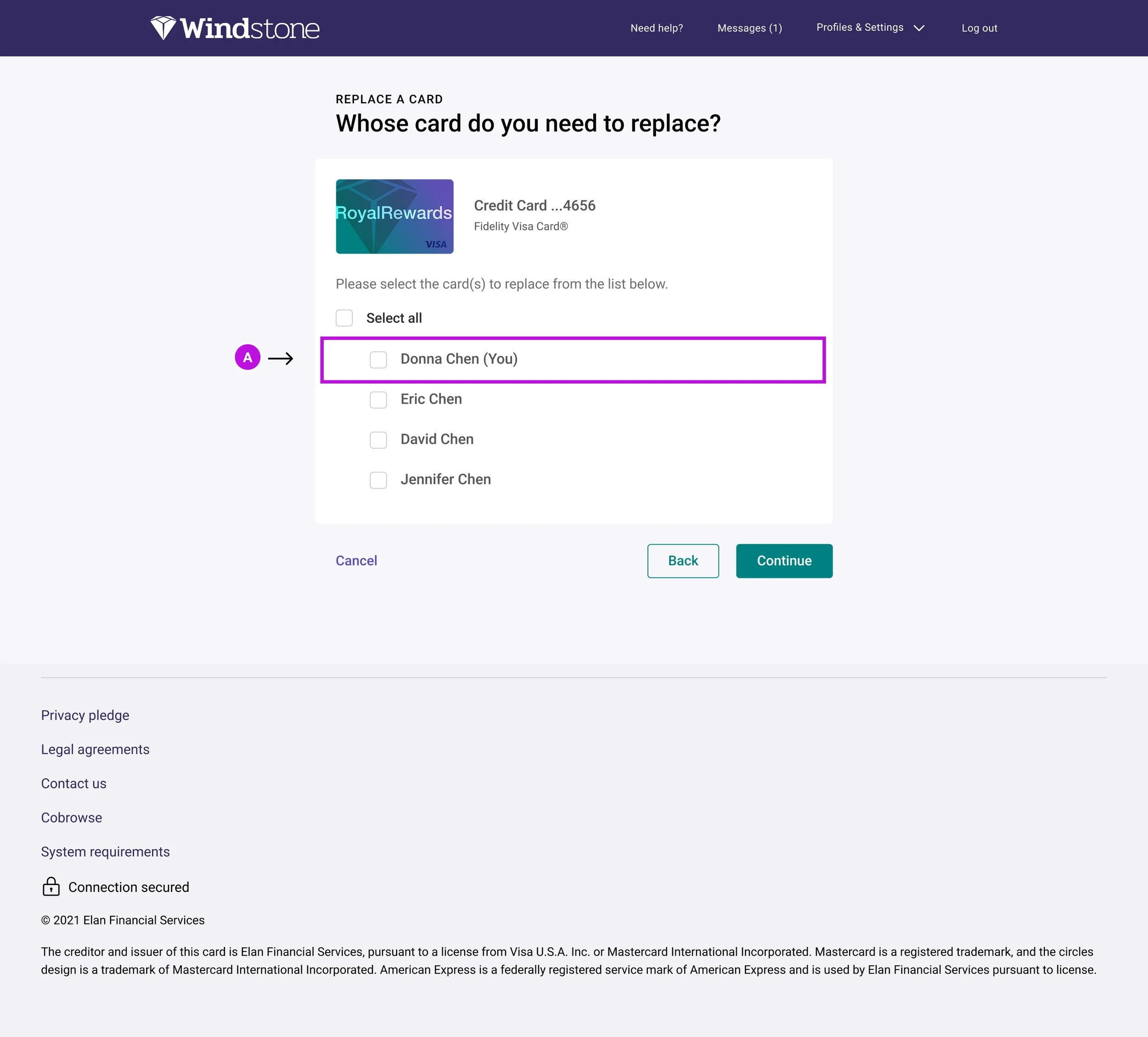

A. Selective card replacement prevents waste

Users choose only cards that need replacing (vs. old system that forced unnecessary replacements)

"Select all" option available for convenience in rare edge cases

Saves $25 per unnecessary card across thousands of orders

Pushed back against PM's initial multi-card default requirement based on user behavior patterns

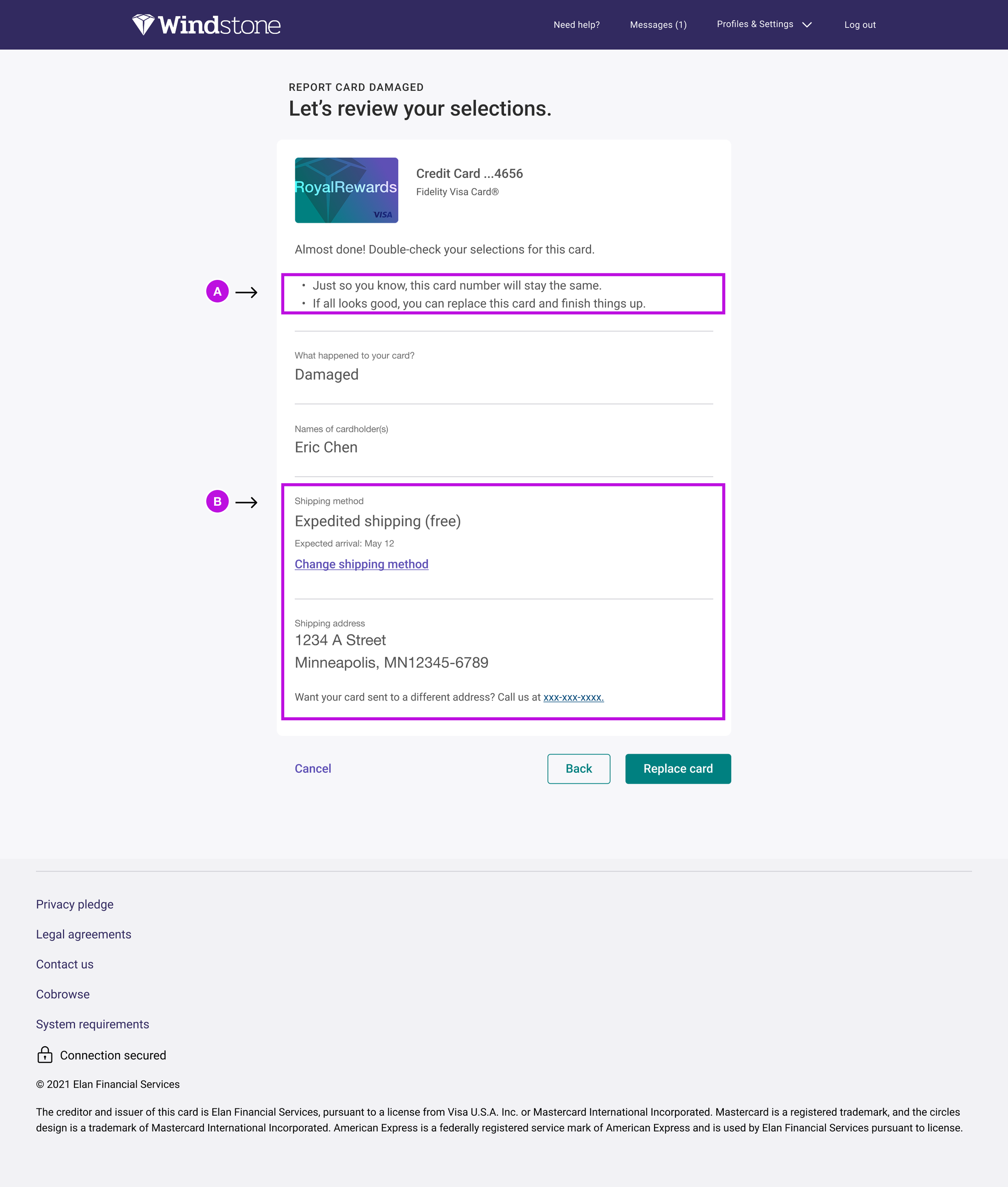

A. Clear communication about card number

Informs users their card number stays the same (reducing confusion and anxiety)

Sets expectations upfront before replacement is finalized

Critical information for users who have card details saved in payment systems

B. Streamlined review with integrated shipping

Combined shipping selection and review into single screen

Reduces clicks and cognitive load for simple replacement scenario

Expedited shipping default ensures fast resolution

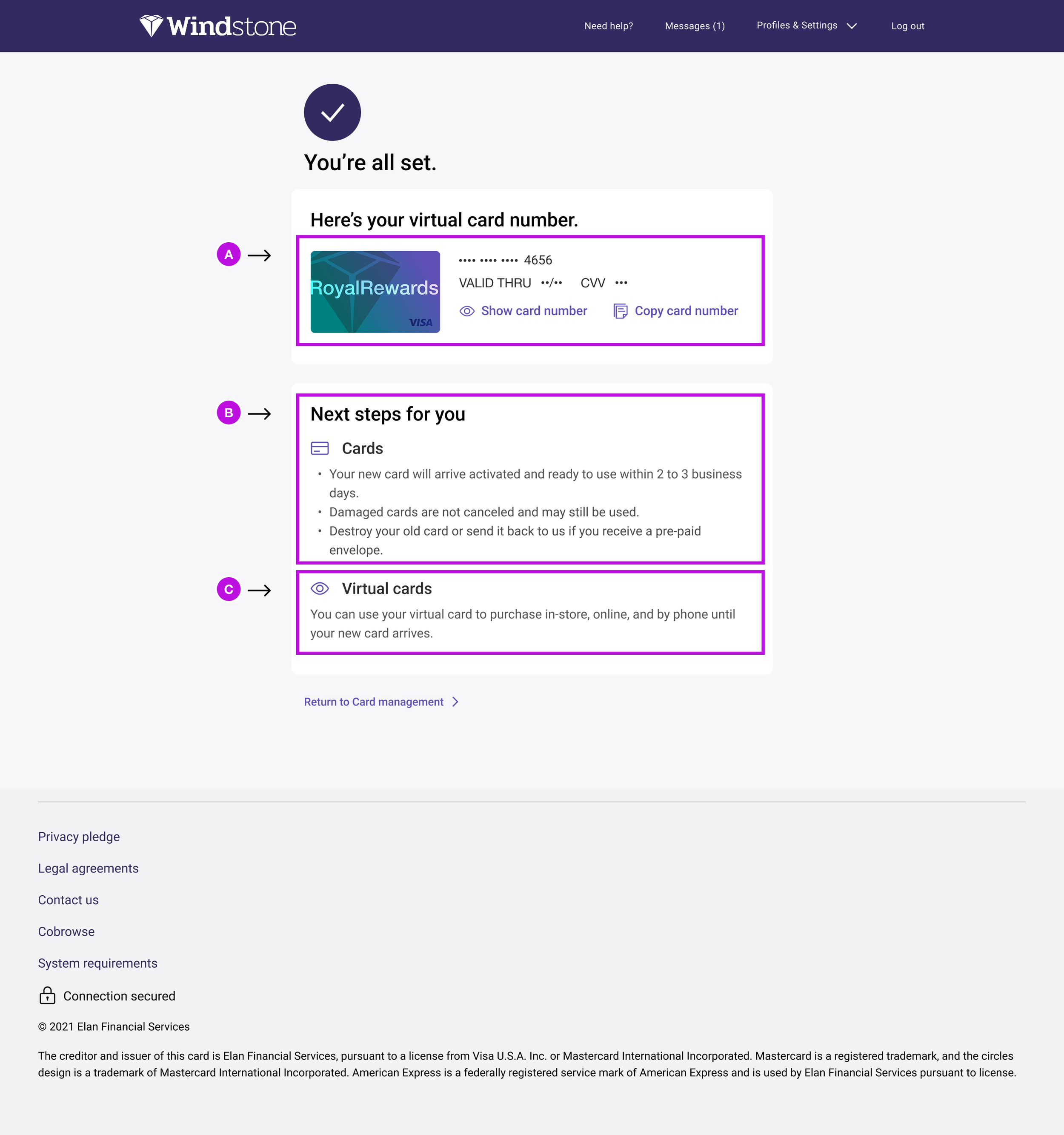

A. Zero downtime with virtual card

Instant access to digital card eliminates waiting period

One-click copy reduces manual entry errors

Users can continue spending immediately

B. Transparent expectations and reassurance

Clear arrival timeline prevents anxious checking

Confirms damaged card remains usable (no rush to activate)

Simple disposal guidance removes decision paralysis

C. Virtual card confidence

Explicitly states where card works (in-store, online, by phone)

Anticipates user questions before they arise

Removes barriers to using new card immediately

View the prototype

Future Enhancements

While this redesign significantly improved the user experience, additional opportunities emerged:

Progress indicator: Add a visual progress bar to help users understand their position in the 6-step flow and set time expectations during an already stressful moment.

Live support integration: Implement in-flow chat widget to provide real-time assistance for users who need clarification without abandoning the process.